san antonio tax rate for cars

Some dealerships may charge a documentary. If you are buying a car for 2500000 multiply by 1 and then multiply by 0825.

Register For A Free Irs Webinar On Helping Small Business Owners Like Yourself Succeed Business Tax Business Owner Small Business Owner

Taxing unit officials must adhere to specific procedures established in Truth and Taxation Laws when they adopt tax rates.

. San Antonio police seek tips on aggravated robbery at Dollar. Some dealerships may charge a documentary fee of 125 dollars. Maintenance Operations MO and Debt Service.

In a unanimous vote of the 10 members present Thursday morning San Antonio City Council approved raising the homestead exemption from the minimum 001 or 5000 up to 10 of a homes value. San antonio collects the maximum legal local sales tax. 625 percent of sales price minus any trade-in allowance.

This is the total of state county and city sales tax rates. 0125 dedicated to the City of San Antonio Pre-K 4 SA initiative. The County sales tax rate is.

The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. Box 839950 San Antonio TX 78283. The most affordable vehicles to insure in San Antonio are typically trucks and vans which run about 60 per month.

The county the vehicle is registered in. The San Antonio Texas general sales tax rate is 625. Every 2019 combined rates mentioned above are the results of Texas state rate 625 the county rate 0 to 05 the San Antonio tax rate 0 to 1375 and in some case special rate 05 to 2.

How Does Sales Tax in San Antonio compare to the rest of Texas. Be prepared to pay a state car sales tax. The san antonio texas sales tax is 625 the same as the texas state sales tax.

Homestead tax exemptions 100 disabled veterans pay no property tax in the state of Texas. The type of license plates requested. The sales tax for cars in Texas is 625 of the final sales price.

San Antonios sales tax currently directs. The latest sales tax rate for San Antonio TX. 825 Sales tax region name.

The County sales tax rate is. San Antonio TX Sales Tax Rate. Vehicle age can also affect your monthly bill.

Car Tax Rate Tools. Or for Texas Roadhouse. 10 mi 25 mi 50 mi 75 mi 100 mi 200 mi 500 mi.

The state in which you live. After you enter those into the blanks you will get the Dallas City Tax which is 01. What is the sales tax rate in San Antonio Texas.

The San Antonio sales tax rate is. People in San Antonio TX have an average commute time of 245 minutes and they drove alone to work. Add this to the Dallas MTA tax at 01 and the state sales tax of 0625 combined together give you a tax rate of 0825.

The December 2020 total local sales tax rate was. Models like the Mazda CX-5 Chevrolet Trailblazer and Nissan Kicks rank high for cheap car insurance in San. The Texas Comptroller states that payment of motor vehicle sales.

2020 rates included for use while preparing your income tax deduction. Cares Act Stimulus Check Tax Implications. Northside is San.

15 Years or Older. The Texas sales tax rate is currently. When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including.

Did South Dakota v. Tax and Tags Calculator. The FY 2022 Debt Service tax rate is 21150 cents per 100 of taxable value.

The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value. Texas residents 625 percent of sales price less credit for sales or use taxes paid to other states when bringing a motor vehicle into Texas that was. The minimum combined 2022 sales tax rate for San Antonio Texas is.

The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. San Antonio TX 78207. The Florida sales tax rate is currently.

The San Antonio sales tax rate is. The Fiscal Year FY 2022 MO tax rate is 34677 cents per 100 of taxable value. Sell A Business Texas Can you imagine a company that helps you buy and sell investment properties ceo gary beasley told fox business stuart.

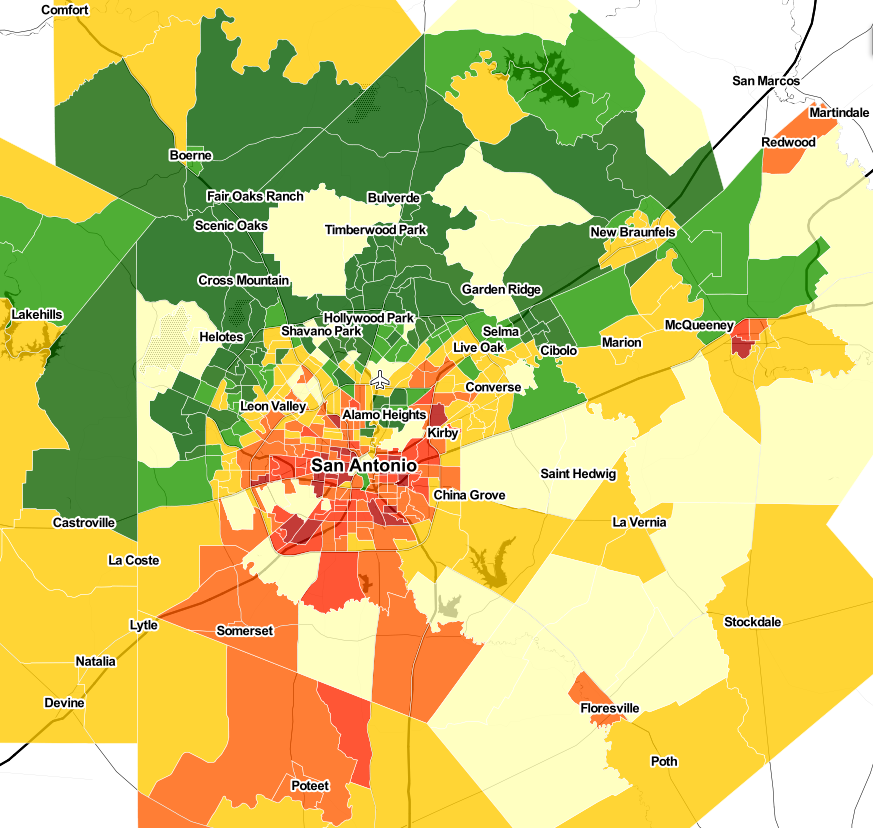

San Antonio in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in San Antonio totaling 2. SUV drivers will see rates of about 63 while the rates for car owners average out to about 66 per month. However an effective doubling of the River Authoritys property tax rate could.

Car insurance rates for a few popular vehicles in San Antonio include the Honda Civic at 1446 per year Toyota Tacoma at 1354 and GMC Sierra at 1486. This percentage depends on your stateNote that some areas also have county city and even school district car taxes tooYour dealer will walk you through this process. This rate includes any state county city and local sales taxes.

You are going to pay 206250 in taxes on this vehicle. The minimum combined 2022 sales tax rate for San Antonio Florida is. New car sales tax OR used car sales tax.

Texas collects a 625 state sales tax rate on the purchase of all vehicles. This is the total of state county and city sales tax rates. The December 2020 total local sales tax rate was also 8250.

These two tax rate components together provide for a total. PE of 238 5146 216 Based. The process used is dependent on benchmark rates known as the effective tax rate and the rollback rate.

The City of San Antonio has an interlocal agreement with the Bexar County Tax Assessor-Collectors Office to provide property tax billing and collection services for the City. Unfortunately dealership andor manufacturer rebates and other incentives might not help you when it comes to lowering the cost associated with car. Did South Dakota v.

San antonio tax rate for cars. In addition to taxes car purchases in Texas may be subject to other fees like registration title and plate fees. Whether or not you have a trade-in.

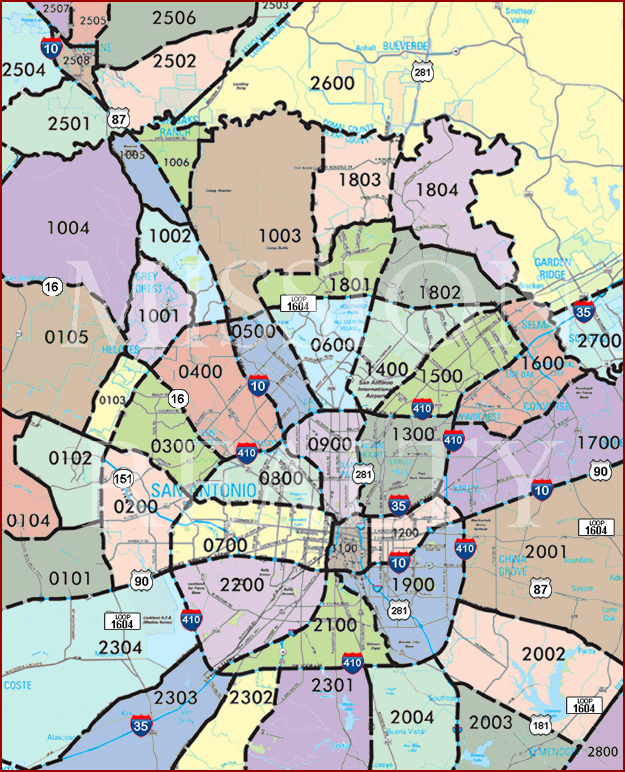

The average cumulative sales tax rate in San Antonio Texas is 822. What is the sales tax rate in San Antonio Florida. Find the local property tax rates for San Antonio area cities towns school districts and Texas counties.

For questions regarding your tax statement contact the Bexar County Tax Assessor-Collectors Office at. The County sales tax rate is. The current total local sales tax rate in San Antonio TX is 8250.

You can find more tax rates and allowances for San Antonio and Texas in the 2022 Texas Tax Tables. The property tax rate for the City of San Antonio consists of two components. Tax and Tags Calculator.

Average car insurance in San Antonio costs 1458 per year or 122 per month for full coverage.

Everything You Need To Know For A San Antonio Vacation

5 Best Neighborhoods In San Antonio For Families Extra Space Storage San Antonio Texas The Neighbourhood San Antonio

Gm Reportedly Working On A Lower Cost Chevy Volt Http Www Aivanet Com 2014 04 Gm Reportedly Working On A Lower Cost Ch Chevy Volt Chevrolet Volt Hybrid Car

Cheap Flights From Phoenix Sky Harbor To San Antonio From 57 Phx Sat Kayak

Financial Planning Investment Brokerage San Antonio Tx Fidelity

San Antonio Furniture Store San Antonio Havertys

Vintage Alocohol Decanter Jim Beam San Antonio Bourbon Etsy Jim Beam Beams Decanter

As Business Booms For People Smugglers Using Trucks In Texas Risks Grow Reuters

As Business Booms For People Smugglers Using Trucks In Texas Risks Grow Reuters

Best Cheap Car Insurance In San Antonio Bankrate

San Antonio Real Estate Market Stats Trends For 2022

Solved Abe Forrester Solutionzip How To Plan Finance Plan Venture Capitalist

Pin En Moving To San Antonio What You Need To Know

Why A Proposed Expansion Of A Veteran Service Dog Program Is Drawing Scrutiny Ahead Of San Antonio Bond Election